Financial Institutions in Japan

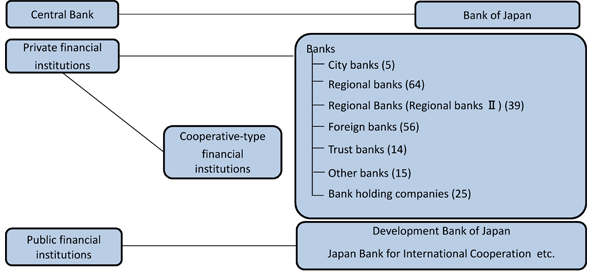

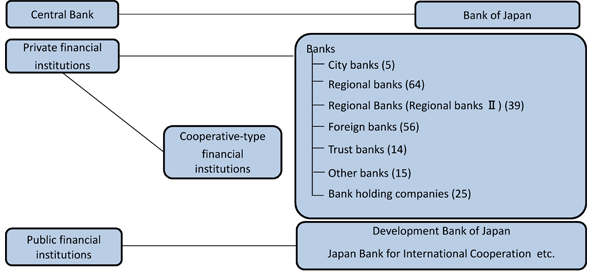

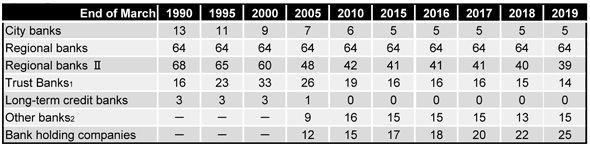

Private financial institutions can be divided into several categories, based on their business function or historical background. The distinction between city banks, regional banks and member banks of the Second Association of Regional Banks (regional banks II) is not a legal one, but is a customary classification for the purposes of administration and statistics. City banks are large in size, with headquarters in major cities and branches in Tokyo, Osaka, other major cities, and their immediate suburbs. Regional banks are usually based in the principal city of a prefecture and they conduct the majority of their operations within that prefecture and have strong ties with local enterprises and local governments. Like traditional regional banks, regional banks II serve smaller companies and individuals within their immediate geographical regions. Most of the regional banks II have converted from mutual savings banks to ordinary commercial banks.

Since 1999, non-financial institutions have entered the banking business by establishing new types of banks such as banks specialized in settlements or internet banks, categorized under other banks in the chart.

The entry of non-financial entities into the banking business led to an amendment to the Banking Act concerning regulation of bank shareholders from April 2002: Shareholders of more than 5% of a bank’s total shares must file with the Financial Services Agency (JFSA), and those seeking to hold 20% or more require JFSA permission to acquire the shares and are subject to JFSA inspection.

- Includes foreign-owned trust banks

- Includes the Resolution and Collection Corporation