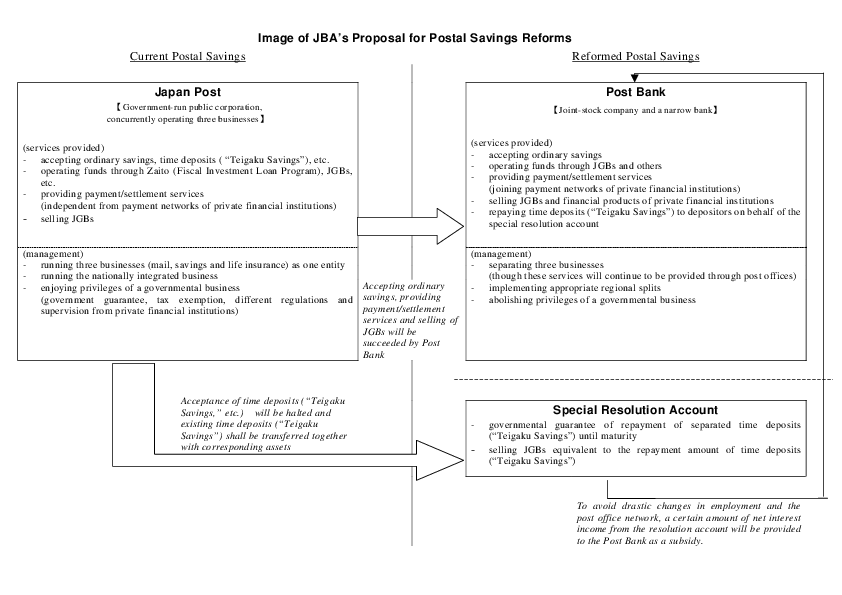

Image of JBA's Proposal for Postal Savings Reforms [17 KB]

Feb.03.2004

Japanese Bankers Association

JBA published a proposal titled "Privatization of Postal Services and the Future of Postal Savings" on February 3 at the "Forum on Public Finance Issues."

This proposal is based on the "Key Points of JBA's View on Privatization of Postal Services and the Future of Postal Savings" drafted on December 24, 2003 and includes supporting data and information.

The summary of the proposal is as follows.

-The funds raised by the Postal Savings are no longer transferred to the Trust Fund Bureau of the Ministry of Finance as a result of April 2001 reforms to the Fiscal Investment Loan Program. Also, a network of branches and ATMs of private financial institutions has been fully developed. Considering these facts, the government-run Postal Savings is not needed "as a convenient and safe vehicle for small-amount savings."

-Postal Savings has various problems and such problems will not be solved even if the Postal Savings is privatized at its present size. Government-run Postal Savings, should, ideally, be abolished to secure stability of the financial system. On the other hand, we need to consider users' convenience and effective utilization of the post office network in discussing this matter. Also, each function of the Postal Savings should be reviewed from the viewpoint of the national economy.

-One of the functions of the Postal Savings, collecting funds through deposits with a savings nature such as "Teigaku Savings" and investing the funds is no longer needed and should be abolished. Abolishing this function is also desirable in terms of reducing interest rate risk. However, functions to provide payment/settlement services and to sell financial products, including government bonds, should be maintained for the sake of users' convenience.

-The privatized Postal Savings (Post Bank) should undertake the functions of providing payment/settlement services and selling financial products under the following conditions:

(1) completely abolishing privileges given it as a governmental business,

(2) implementing the same regulations and supervision as private financial institutions,

(3) separating the three businesses of mail, savings and life insurance, and

(4) splitting the Post Bank into appropriate sizes geographically.

As long as the government holds shares in the Post Bank, the Bank should not be involved in loan provision to avoid risks, and should solely be engaged in payment/settlement services. A ceiling should also be set on deposits.