Overview of the Proposal [21 KB]

Mar.23.2004

Japanese Bankers Association

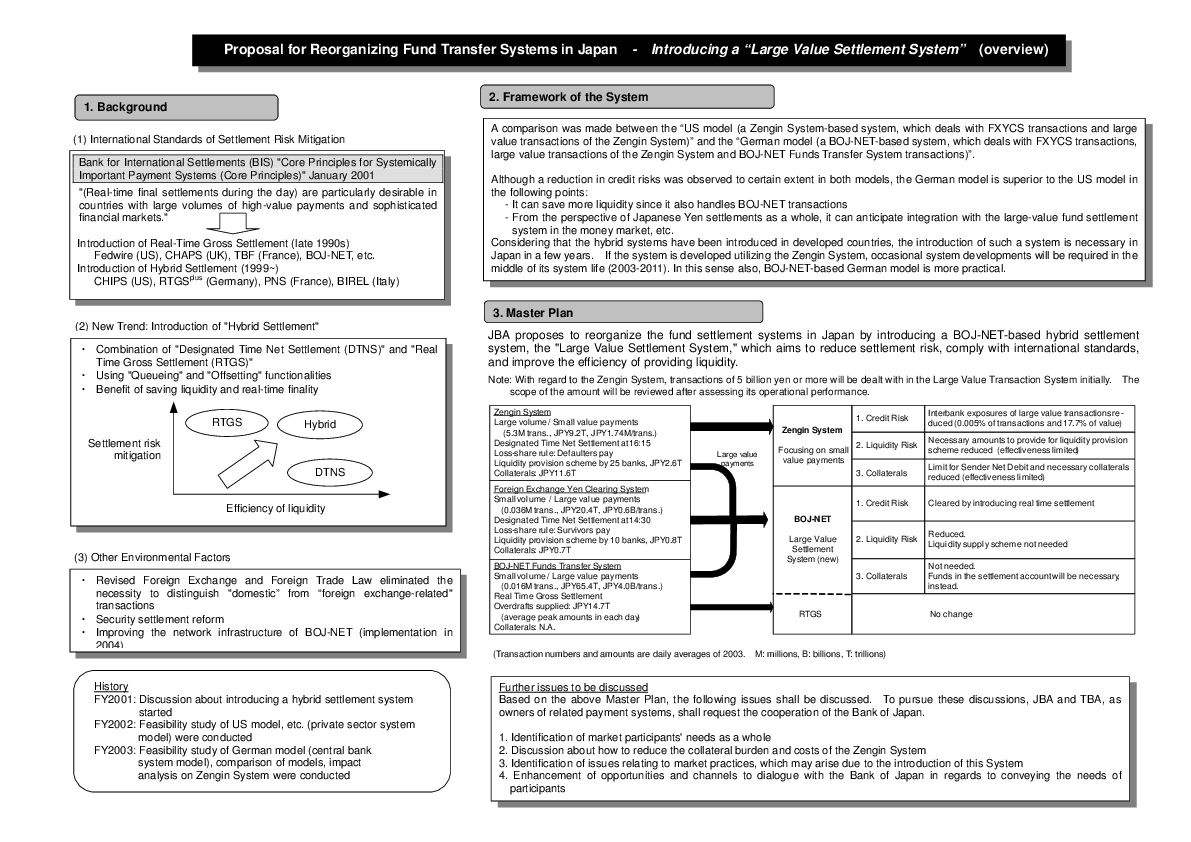

On March 23, the Board of Directors of the Japanese Bankers Association (JBA) approved a report, which proposes the introduction of a "Large Value Settlement System (tentative name)," that aims to reduce settlement risk, comply with international standards, and improve the efficiency of providing liquidity.

The proposal envisages the integration of large value fund settlements in Japan. If this proposal is realized, fund transfer systems in Japan (the BOJ-NET Funds Transfer System1, Foreign Exchange Yen Clearing System (FXYCS)2 and Zengin System3) will be reorganized into a Large Value Settlement System utilizing the BOJ-NET and the Zengin System that will mainly deal with clearing of small value payments. (Please refer to the attachment for an overview of the proposal.)

JBA submitted the report to the Bank of Japan today, requesting its cooperation to realize this proposal. JBA, with the cooperation of the Bank of Japan and other related parties, will further discuss this matter with the aim to establish and operate the system in the near future.

Attachment

| 1 | A network system that links private financial institutions and the Bank of Japan (BOJ-NET) to conduct final settlements of fund transfers between them. The system is managed and operated by the Bank of Japan. |

| 2 | A network system that clears inter-bank yen payments resulting from foreign exchange transactions. Although FXYCS is managed by the Tokyo Bankers Association (TBA), its network system uses BOJ-NET. |

| 3 | A network system that exchanges domestic fund transfer messages between private financial institutions and clears inter-bank net balances. The system is managed by the Organization for Management of Domestic Fund Transfers (Secretariat: TBA). |